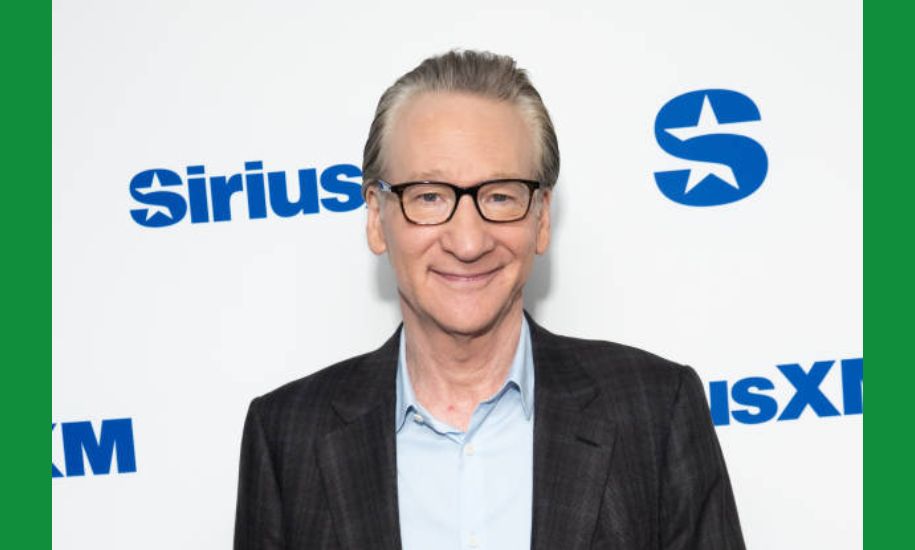

Bill Maher Net Worth 2024, Who Is Bill Maher? His Career, Relationships, and More

Introduction

Mating Press presents an in-depth look into one of the most polarizing and influential figures in American television and political commentary, Bill Maher. In this article, we explore Bill Maher net worth, his career trajectory, his personal life, and answers to some of the most common questions about him, such as his religious background, relationships, and the return of his popular HBO show, Real Time with Bill Maher.

Who is Bill Maher?

Profile Summary

| Attribute | Details |

|---|---|

| Full Name | William Maher Jr. |

| Date of Birth | January 20, 1956 |

| Birthplace | New York City, USA |

| Nationality | American |

| Religion | Raised Catholic, mother was Jewish |

| Profession | Comedian, Political Commentator, TV Host |

| Net Worth 2024 | $140 million |

| Famous For | “Real Time with Bill Maher,” “Politically Incorrect” |

| Marital Status | Unmarried |

| Notable Relationships | Coco Johnsen, Noor Alfallah |

| Investments | Stake in New York Mets |

Bill Maher is a well-known American comedian, political commentator, and television host. With a career spanning over four decades, he has made a significant impact on political satire and social commentary. Maher is best known for hosting HBO’s “Real Time with Bill Maher,” a show that blends humor with serious political discussions. He previously hosted “Politically Incorrect,” which aired on Comedy Central and later on ABC.

Born on January 20, 1956, in New York City, Bill Maher has built a reputation for his sharp wit, controversial opinions, and fearless approach to tackling sensitive topics. He is recognized as one of the most influential figures in political comedy, earning numerous accolades throughout his career.

Bill Maher Net Worth 2024

As of 2024, Bill Maher net worth is estimated to be around $140 million. His fortune is largely attributed to his successful television career, stand-up performances, book deals, and investments. Maher earns an impressive salary of approximately $10 million per year from his HBO show “Real Time with Bill Maher.”

In addition to his television earnings, Maher has made smart investments over the years. In 2012, he bought a minority stake in the New York Mets, which significantly contributed to his financial portfolio. His wealth has steadily increased thanks to his business acumen and consistent success in the entertainment industry.

Bill Maher Net Worth According to Forbes

While Forbes does not regularly list Maher among the highest-paid entertainers, his net worth is comparable to some of the wealthiest comedians in the industry. His HBO contract, lucrative stand-up tours, and investments make him one of the most financially successful political commentators in the world.

Is Bill Maher Jewish?

Bill Maher’s religious background is often a topic of curiosity. He was born to a Catholic father and a Jewish mother. However, he was raised in the Catholic faith until his early teenage years when his family stopped attending church. Despite his mother being Jewish, Maher does not identify as Jewish in practice or belief.

Maher has been a vocal critic of organized religion, often addressing the subject in his stand-up acts and on his show. His 2008 documentary, “Religulous,” explored and criticized religious beliefs around the world.

Bill Maher Family

Bill Maher was born into a middle-class family in New York City. His father, William Aloysius Maher Jr., was a radio announcer and news editor, while his mother, Julie Maher, was a nurse. Maher has one sister, Kathy Maher.

Bill Maher’s Father – William Aloysius Maher Jr.

Maher’s father played a significant role in shaping his early life. As a radio announcer and editor, William Maher Jr. had a deep connection to media and news, which may have influenced Bill’s later career as a political commentator. However, Maher has mentioned that his father’s strong Catholic beliefs clashed with his later views on religion.

Bill Maher’s Mother – Julie Maher

Julie Maher was of Jewish descent and worked as a nurse. While she did not practice Judaism actively, her Jewish heritage has been a part of Maher’s family background. Maher has credited his mother for instilling in him a questioning and analytical mindset, which is evident in his approach to political and social issues.

When Does Real Time with Bill Maher Return in 2024?

“Real Time with Bill Maher” continues to be one of HBO’s most successful talk shows. In 2024, the show is expected to return for a new season in January. The program typically runs on a weekly schedule, featuring panel discussions, guest interviews, and Maher’s signature monologue that blends comedy with current events.

Bill Maher Girlfriend His Personal Life – Wife & Children

Bill Maher’s Wife

Bill Maher has never been married. He has been open about his views on marriage, stating that he enjoys his independence and does not believe in lifelong commitment through marriage.

Bill Maher’s Children

Maher does not have any children. He has often joked about his decision to remain child-free, emphasizing his preference for personal freedom and a career-focused life.

Bill Maher’s Girlfriends

Over the years, Bill Maher has been linked to several high-profile relationships. He has dated models, actresses, and businesswomen but has never settled down permanently.

Coco Johnsen

One of Maher’s most well-known relationships was with Coco Johnsen, a former Playboy model. The two dated for over a year, but their relationship ended in a legal dispute, with Johnsen filing a lawsuit against Maher, which was eventually dismissed.

Noor Alfallah

More recently, Maher has been rumored to be dating Noor Alfallah, a producer who has been linked to several high-profile men, including Mick Jagger and Al Pacino. However, Maher has not publicly confirmed any long-term commitment.

Bill Maher Career

Bill Maher’s career began in stand-up comedy in the late 1970s. His early performances gained attention, leading to appearances on talk shows such as “The Tonight Show Starring Johnny Carson.”

Politically Incorrect

In 1993, Maher launched “Politically Incorrect,” a late-night talk show that aired on Comedy Central and later on ABC. The show featured panel discussions on controversial topics, often sparking heated debates. However, it was canceled in 2002 after Maher made controversial comments regarding the 9/11 attacks.

Real Time with Bill Maher

In 2003, Maher debuted “Real Time with Bill Maher” on HBO, a show that combines comedy with political and social discussions. It has remained one of the longest-running political talk shows on television, bringing in prominent guests, including politicians, celebrities, and journalists.

Frequently Asked Questions (FAQs)

1. What is Bill Maher’s net worth in 2024?

Bill Maher’s estimated net worth in 2024 is around $140 million, primarily earned through his HBO show, stand-up comedy, and smart investments.

2. Has Bill Maher ever been married?

No, Bill Maher has never been married. He has openly stated that he enjoys his independence and does not believe in traditional marriage.

3. What is Bill Maher’s religious background?

Maher was raised Catholic by his father but has a Jewish mother. However, he does not identify with any religion and is a vocal critic of organized religion.

4. When does ‘Real Time with Bill Maher’ return in 2024?

The show is expected to return in January 2024, continuing its weekly political satire and discussion format on HBO.

5. What are Bill Maher’s most famous shows?

Maher is best known for hosting ‘Real Time with Bill Maher’ on HBO and previously hosted ‘Politically Incorrect’, which aired on Comedy Central and later ABC.

Bill Maher Legacy

Bill Maher has cemented his legacy as one of the most influential political commentators and comedians of his time. His fearless approach to controversial topics, sharp wit, and deep political insights have earned him both praise and criticism. Whether one agrees with his views or not, Maher remains a significant voice in American media.

His impact extends beyond television, as he has also written books, performed numerous stand-up specials, and produced documentaries. His influence on political satire and social discourse continues to shape conversations in modern society.

Final Thoughts

Bill Maher net worth in 2024 stands as a testament to his successful career and financial acumen. From his early days in stand-up comedy to becoming a television powerhouse, Maher has built a lasting career that continues to thrive. His contributions to political discourse and entertainment will likely remain relevant for years to come.

For more articles like this, visit Mating Press.