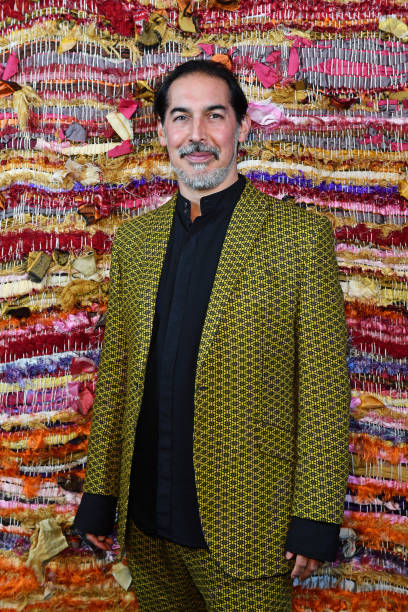

Who is Suneil Setiya? A Deep Dive into His Career, Net Worth, and More

Suneil Setiya is a prominent figure in the world of finance, particularly in the quantitative hedge fund industry. As the co-founder and co-chief executive officer of Quadrature Capital, Setiya has built a reputation for his expertise in algorithmic trading and investment strategies. With a background in physics and an impressive career in quantitative finance, he has played a significant role in shaping modern investment approaches.

Beyond finance, Setiya is also known for his philanthropic efforts, particularly in addressing climate change through the Quadrature Climate Foundation (QCF). His success has positioned him as one of the wealthiest individuals in the financial sector, making him a key player in both investment and global sustainability initiatives.

Suneil Setiya’s Career Journey

Suneil Setiya began his journey in the world of finance after completing his studies in physics at the University of Oxford. His academic background in physics provided him with a strong foundation in quantitative analysis, which he later applied to financial markets. Setiya’s early career saw him working in algorithmic trading, where he honed his skills in developing quantitative models for market predictions.

In 2010, he co-founded Quadrature Capital, a quantitative hedge fund based in London. The firm specializes in algorithm-driven trading strategies, leveraging artificial intelligence and machine learning to execute trades with high efficiency. Under Setiya’s leadership, Quadrature Capital has grown significantly, establishing itself as one of the leading quantitative hedge funds in the world.

Suneil Setiya’s Role in Quadrature Capital

Quadrature Capital, co-founded by Suneil Setiya, is a hedge fund that operates primarily on algorithmic trading strategies. The firm uses advanced quantitative techniques to analyze financial markets and execute trades with precision. Unlike traditional hedge funds, Quadrature Capital relies heavily on mathematical models and artificial intelligence to identify profitable trading opportunities.

The firm has gained recognition for its innovative approach to investment, attracting significant capital from institutional investors. Quadrature Capital has also been noted for its employee compensation, with reports indicating that it pays some of the highest salaries in the hedge fund industry. This success can be attributed to Setiya’s leadership and strategic vision, which have helped the firm navigate complex market conditions and maintain consistent profitability.

Suneil Setiya’s Net Worth

Suneil Setiya’s financial success is reflected in his net worth, which places him among the wealthiest individuals in the hedge fund industry. Alongside his business partner Greg Skinner, Setiya was ranked 161st on the Sunday Times’ Rich List in 2024, with an estimated combined wealth of £1.015 billion. This impressive net worth is a testament to his success in quantitative finance and his ability to generate substantial returns for investors.

While much of his wealth comes from his stake in Quadrature Capital, Setiya has also made strategic investments in various ventures. His financial standing allows him to engage in philanthropy, supporting initiatives that align with his interests in environmental sustainability and technological innovation.

Suneil Setiya’s Personal Life and Wife

Despite his public presence in the financial world, Suneil Setiya maintains a private personal life. There is limited publicly available information about his family, including details about his wife. Unlike many high-profile financial executives, Setiya prefers to keep his personal affairs out of the media spotlight.

This discretion aligns with his overall approach to business and philanthropy, where he focuses on results rather than public recognition. While there may be speculation about his personal life, Setiya remains committed to maintaining a low profile outside of his professional endeavors.

Suneil Setiya’s Philanthropy and the Quadrature Climate Foundation

In addition to his financial achievements, Suneil Setiya is deeply involved in philanthropy, particularly in climate change initiatives. In 2019, he co-founded the Quadrature Climate Foundation (QCF) with Greg Skinner. The foundation aims to address environmental challenges by funding innovative research and projects that contribute to sustainability.

One of QCF’s most notable contributions is its $40 million investment in solar geoengineering research. This initiative focuses on developing technological solutions to mitigate climate change, reflecting Setiya’s commitment to leveraging science and technology for global impact. Through QCF, he continues to support efforts that align with his vision for a sustainable future.

Suneil Setiya’s Real Estate and Luxury Investments

As a billionaire hedge fund executive, Suneil Setiya has also made headlines for his luxury real estate investments. In 2021, he was reportedly in talks to purchase a penthouse in London’s One Hyde Park for approximately $153 million. This property, spanning 14,000 square feet, is one of the most expensive residences in the world, highlighting Setiya’s significant personal wealth.

Luxury investments like these reflect the financial success of top hedge fund managers, who often allocate their wealth to high-value assets. While Setiya’s primary focus remains on finance and philanthropy, his real estate investments further underscore his status as a key player in the global financial landscape.

The Legacy of Suneil Setiya

Suneil Setiya’s contributions to the hedge fund industry, philanthropy, and quantitative finance make him a notable figure in modern investment history. His leadership at Quadrature Capital has redefined algorithmic trading, while his efforts through the Quadrature Climate Foundation showcase his dedication to global sustainability.

Setiya’s journey from a physics student to a billionaire hedge fund executive exemplifies the power of quantitative analysis in finance. As he continues to shape the financial and philanthropic landscapes, his impact is likely to be felt for years to come.

Conclusion

Suneil Setiya is a remarkable figure in the world of finance, known for his expertise in quantitative trading, his leadership at Quadrature Capital, and his commitment to philanthropy. His net worth, estimated at over a billion dollars, reflects his success in the hedge fund industry. While details about his personal life, including his wife, remain private, his professional achievements speak volumes about his influence.

As he continues to lead Quadrature Capital and invest in climate initiatives, Setiya’s legacy will be defined by his contributions to finance and global sustainability. For those interested in quantitative finance, investment strategies, and philanthropy, Suneil Setiya’s journey serves as an inspiring example of success in multiple domains. This article is proudly featured on Mating Press, bringing you deep insights into finance and business.